Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing.

Sustainable investing made simple

The new Empire Life Global Sustainable Equity GIF is one of the few segregated funds focused on sustainability. The fund invests in global companies that we believe exhibit superior Environmental, Social, and Governance (ESG) characteristics1 and a management approach that is focused on quality.

What is sustainable investing?

An investment approach that incorporates ESG factors into the investment process. Read about Empire Life's ESG philosophy.

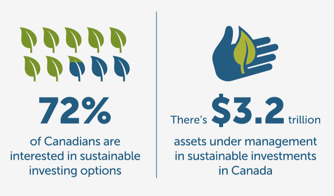

Client demand and interest for sustainable investing is strong2

Morningstar Sustainability RatingTM out of 7,756 Global Equity funds as of 31-08-22. Based on 100% of AUM. Data is based on long positions only.

The Empire Life Global Sustainable Equity GIF has received a 5 Globe Morningstar Sustainability RatingTM. That’s their highest rating, and means that the fund is in the best 10% of lowest ESG risk.1

The Rating is intended to measure how well the issuing companies of the securities within a fund’s portfolio holdings are managing their financially material ESG risks, relative to the fund’s Morningstar Global Category peers.

Why invest?

![]() High quality, high conviction

High quality, high conviction

Corporate responsibility and taking a sustainable approach to business is a hallmark of quality. Giving investors greater confidence of the underlying stability and return potential of the fund’s holdings.

Broad global perspective

Broad global perspective

With a focus on global equity, the fund can better diversify across sectors and regions providing clients a greater potential for capital preservation and long-term performance relative to the category.

![]() Sustainability focused

Sustainability focused

Focusing on companies that demonstrate sustainable business practices has the potential to reduce risk and enhance long-term portfolio returns.

Let’s take a closer look at these three points to see how the Empire Life Global Sustainable Equity GIF can help you meet your investment–and personal–goals.

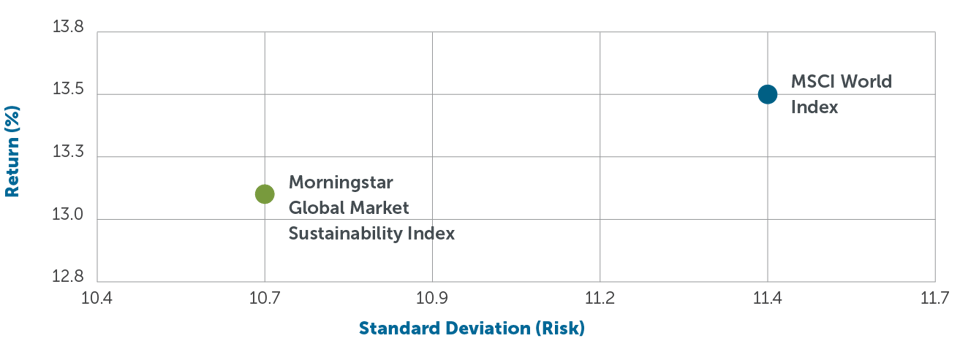

Taking a sustainable approach without sacrificing growth potential

The addition of a Global Sustainable mandate (as represented by the Morningstar Global Market Sustainability Index) to an existing global portfolio (as represented by the MSCI World Index) can be beneficial from a risk-return standpoint. The Global Sustainable mandate delivered similar returns, with substantially less risk over a five-year period.

Source: Morningstar Research Inc., 5yr December 1, 2016-November 30, 2021, in Canadian dollar returns. MSCI World Index www.msci.com.

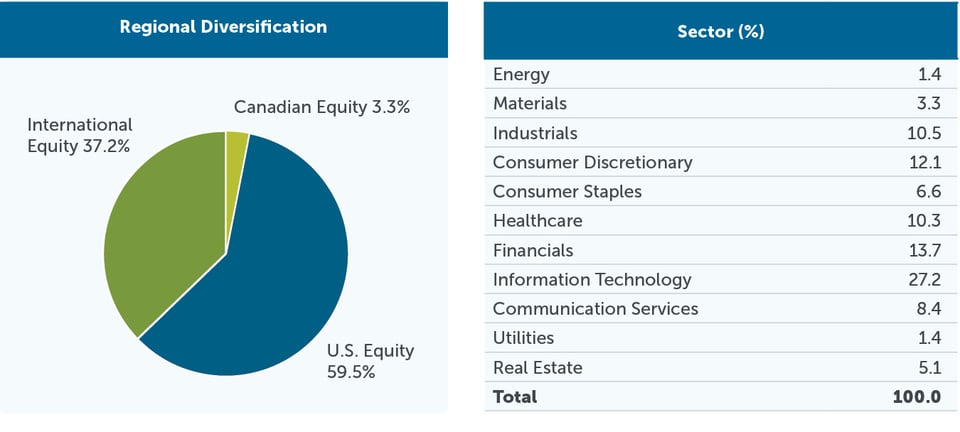

Sustainability and diversification

A focus on sustainability may provide investors with a greater potential for capital preservation and long term performance relative to industry peers. The Morningstar Global Market Sustainability Index (shown below) provides Empire Life Global Sustainable Equity GIF the necessary building blocks to provide investors the broad regional and sectoral diversification they need to assist in achieving their financial goals.

Source: Morningstar Research Inc., November 30, 2021. For illustrative purposes only. The above graph does not reflect the asset allocation for Empire Life Global Sustainable Equity GIF.

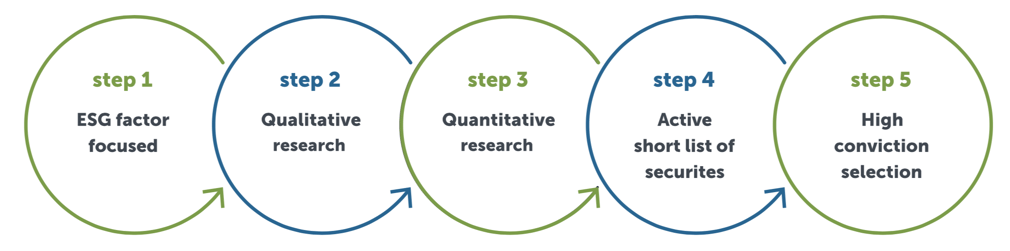

A sustainably focused investment approach

Securities are primarily selected from Morningstar Global Market Sustainability Index-a universe of approximately 1,600 global companies with demonstrated enhanced management of Environment, Social and Governance (ESG) factors.

-

Consistent with our bottom-up investment approach, the fund invests in businesses with a strong fundamental outlook

-

The fund aims to exhibit better ESG characteristics1 than other Empire Life global equity funds by including businesses with favourable sustainability dynamics

The Empire Life Global Sustainable Equity GIF is offered in our Guaranteed Investment Fund policies. Here are some GIF highlights:

-

Choice of death benefit and maturity guarantees with 75/75, 75/100 and 100/100 - all offer:

-

Automatic annual death benefit resets to age 80

-

Potential for higher growth with up to 100% equity exposure available

-

-

100% death benefit guarantee on deposits made to age 90 on 75/100 & 100/100 series

-

Diversified investment choices ranging from fixed income to 100% equity, including our tactically managed Emblem GIF Portfolios and Multi-Strategy GIFs

-

GIF Preferred Pricing starting at $250,000 per household

Download Householding Form -

Purchase options of Front End, No Load and Fee For Service

Learn more about all our global funds

Learn more about all our global funds

Global Balanced Funds:

Empire Life Global Asset Allocation GIF

Empire Life Global Balanced GIF

Global Equity Funds:

Empire Life American Value GIF3

Empire Life Global Dividend Growth GIF3

Empire Life Global Equity GIF3

Empire Life Global Smaller Companies GIF3

Empire Life International Equity GIF3

Empire Life Multi-Strategy Global Equity GIF

Empire Life Multi-Strategy Global Growth GIF

Empire Life Multi-Strategy US Equity GIF

Global Portfolio Funds:

Empire Life Emblem Global Conservative Portfolio GIF

Empire Life Emblem Global Balanced Portfolio GIF

Empire Life Emblem Global Moderate Growth Portfolio GIF

Empire Life Emblem Global Aggressive Growth Portfolio GIF

Empire Life Multi-Strategy Global Conservative Portfolio GIF

Empire Life Multi-Strategy Global Balanced Portfolio GIF

Empire Life Multi-Strategy Global Moderate Growth Portfolio GIF

FOR ADVISOR USE ONLY.

1 Morningstar Research Inc. / Sustainalytics as of August 31, 2022. 22020 RIA Investor Opinion Survey. 3 This is the marketing name for the fund. The fund’s legal name excludes “Empire Life” and “GIF” and includes “Fund” at the end of its name.

Historical Sustainability Score as of August 31, 2022. Sustainability Rating as of August 31, 2022. Sustainalytics provides company-level analysis used in the calculation of Morningstar’s Historical Sustainability Score.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value.

© 2022 Morningstar. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

CONTACT US

The Empire Life Insurance Company

259 King St. E. Kingston, Ontario K7L 3A8

1 877 548-1881

empire.ca, info@empire.ca

8:30 a.m. to 5:00 p.m. EST, weekdays

®Registered Trademark of The Empire Life Insurance Company. Policies are issued by The Empire Life Insurance Company.