Proudly Canadian, Empire Life helps Canadians build wealth, protect their financial security, and achieve physical, mental and financial health. What sets us apart from others is simple: our people, our products and our digital processes.

According to NMG’s 2024/2025 Canadian Individual Life Insurance study1, Empire Life was ranked #2 on NMG’s Business Capabilities Index.

.png?width=1280&height=376&name=INS-1993995_Empire%20life%20rankings_En%20(2).png)

Launched January 1, 2025, advisors can take part in our Empire Life advisor life insurance bonus program, the Growth & Loyalty Bonus that allows you to get rewarded in two ways: for growth and for loyalty. We will pay a bonus calculated on net annualized first year commission (FYC) of between 5% to 25% to qualifying advisors.

Extended for 2025, earn a commission bonus for actively promoting the value of Empire Life Guaranteed Investment Funds (GIF) to new and existing clients. GIF Growth Commission Bonus: Your formula for higher commission. Total GIF Deposits x GIF Deposit Bonus Rate x Net GIF Growth Bonus Factor = GIF Growth Commission Bonus The growth commission bonus is available on deposits made between January 2 to December 31, 2025.

We’re real people and we’re here for you. Our 100% Canadian-based teams are focused on getting advisors the answers and information they need to serve their clients quickly and efficiently. We recently added many new team members across key operational areas like Customer Service and Underwriting to ensure we can continue to meet the high service standards our advisors expect even as our sales volumes have grown to unprecedented levels.

Our expert teams are in your corner when you need us. From product training to help with large and complex cases, your success is our first priority. Check out the resources available to you:

Having a comprehensive product line that focuses on the needs of families and small businesses means being there for those who need us, when they need us most.

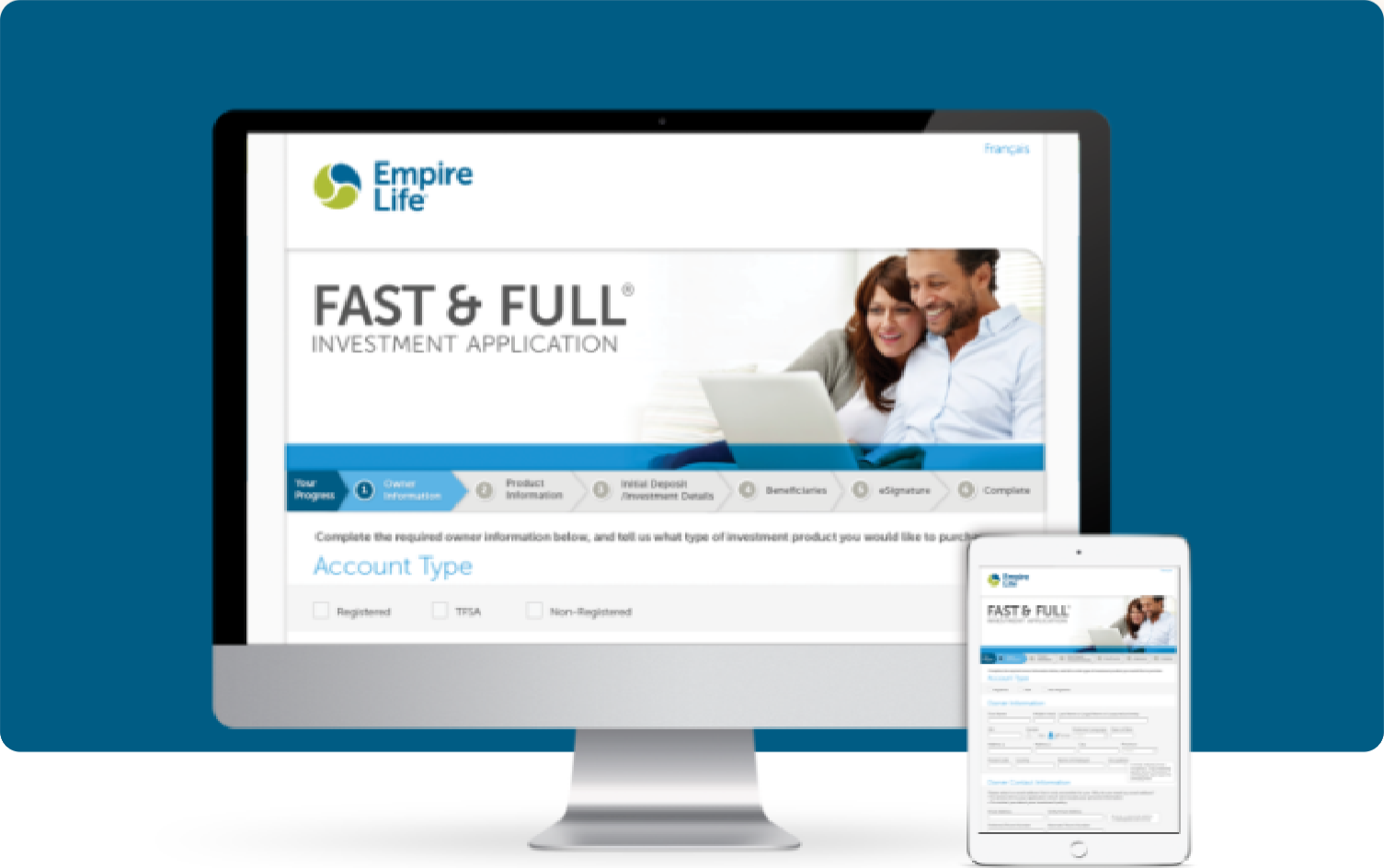

Empire Life is recognized as an industry leader in digital innovation. More than ever before, clients want digital options. We have the tools, like our Fast & Full®, our digital eApplication, that you need to serve those clients — on their terms and yours. Get to know our Fast & Full Life App:

Online application process for segregated fund and guaranteed interest contracts.

Don’t have a contract with Empire Life yet? Talk to your MGA today about becoming contracted with Empire Life and experience the difference for yourself.

1 Canadian Individual Life Insurance Study according to mass affluent & mass market segments, NMG Consulting, 2022, 2023, 2024, 2025.

2 A description of the key features of the individual variable insurance contract is contained in the Class Plus 3.0 Information Folder. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value.

© Registered trademark of The Empire Life Insurance Company. Policies are issued by The Empire Life Insurance Company. All rights reserved – 2025.