/Test%202400x608%20GettyImages-1470077138.png?width=2000&height=506&name=Test%202400x608%20GettyImages-1470077138.png)

RRSP & TFSA Toolbox

Build your business in 2024 with Empire Life's RRSP and TFSA resources

Your Empire Life advisor toolbox gives you quick access to informative advisor and client approved resources that can help make the 2024 RRSP and TFSA season a success for you.

/Group%206491.png?quality=high&width=85&height=100&name=Group%206491.png)

Help clients earn a 4.5%1 target return tax-free

Give your clients the benefit of segregated fund guarantees and an attractive tax-free return on their investments with a TFSA.1 For a limited time, investing in the Empire Life Money Market Fund in their TFSA gives your client an after tax target rate of return of 4.5%.1, potentially more than double what they would earn in a non-registered account.2

Make additional deposits online

Have clients looking to make additional RRSP or TFSA contributions? You can make them online through your Empire Life My Advisor Dashboard.

Empire Life RRSP Centre for advisors

A Registered Retirement Savings Plan (RRSP) lets your clients build tax-deferred retirement savings. Our advisor RRSP Centre explains a range of investment solutions designed to meet your clients’ needs.

Empire Life TFSA advisor page

A Tax-Free Savings Account (TFSA) has become a key component of many clients' financial plans. This advisor page provides you with key facts and a range of eligible investment products.

RRSP vs TFSA. Which is best for your client?

Clients often ask advisors whether they should invest in an RRSP or a TFSA. This document provides you with three scenarios, from a tax perspective, to discuss with clients when determining if an RRSP or TFSA is the best fit.

RRSP, TFSA and Investments Loans

Borrowing to fund RRSPs and TFSAs can help your clients build their wealth faster and more effectively. Get started today with information and applications at your fingertips within this web resource.

2024 RRSP and TFSA details

Find contribution deadlines and RRSP and TFSA facts here.

Resources to share with your clients

Resources for use with clients to explain RRSPs and TFSAs and the many investment options Empire Life provides to help clients reach their goals. Share the brochures and direct your clients to the web pages below to start retirement savings conversations.

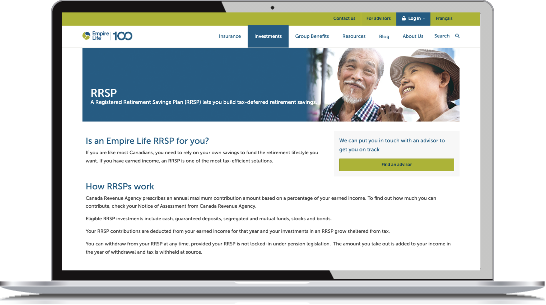

Empire Life RRSP - Client page

Many Canadians rely on their own savings to fund the retirement lifestyle they want. A RRSP is one of the most tax-efficient ways for your clients to build tax-deferred retirement savings. This webpage resource explains how RRSPs work, key features and benefits and what happens when a client retires.

Not all RRSPs are the same - Client brochure

Formatted to fit into a standard envelope this piece helps inform clients about RRSP taxation, spousal contributions, RRSP loans and the advantages of holding segregated funds3 in RRSPs.

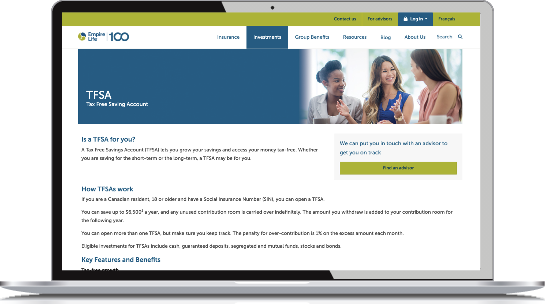

Empire Life TFSA - Client page

A webpage resource that explains to clients how TFSAs work, and their features and benefits.

Class Plus 3.0 RRSP video - Client video

Setting a retirement goal is a good first step, but clients also need to consider the income they want in retirement and if they’ll have enough retirement savings to last. Follow along with this video as John, a father, enjoys time with his kids while considering how to fund his retirement so he’ll have retirement income for life.

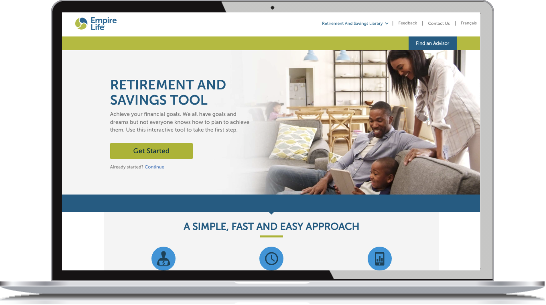

Retirement and savings tool - Client retirement calculator

Helps clients understand how much income they can expect to receive in retirement, and estimate the future value of their retirement savings. This popular consumer tool also creates a personalized report that they can share with their advisor to get the conversation started.

Additional business building resources to help you grow your practice:

If you have any questions, please contact us at 1 866 894-6182 or by email at salescentre@empire.ca.

1 Empire Life’s target is to provide the annualized 4.5% target rate of return for a limited period until March 31, 2024. Empire Life may, at its discretion, at any time and without prior notice, increase or decrease the amount of the Money Market management fee waived, which will therefore affect the rate of return. Empire Life reserves the right to revise and/or cancel this rate at any time.

2 After tax return assumes a marginal tax rate of 53.53% for other income in Ontario. Client’s actual after tax rate of return will vary by income level and province of residence.

3 Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing.

FOR ADVISOR USE ONLY

The information contained herein is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance made on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decision.