What time is the right time?

From 2022 to 2023, Interest rates saw a meteoric rise in most developed countries.

That higher rate environment made money market funds a safe and attractive option for investors, offering them decent returns while they waited out the perceived market turbulence.

But waiting can have long-term consequences - investors may have enjoyed their safe return, but markets have shown they can quickly outpace those interest rate returns.

A focus on the short term can lead to long term losses.

For most of 2022 we saw steep interest rate increases coupled with an equity market downturn. While interest rates persisted until recently equity markets showed early signs of recover and have since surpassed their previous peak.

Equity Market Index Returns vs. Money Market Return

Growth of $10,000 for various asset classes

Source: Morningstar Research Inc. as of May 31, 2024. Start date May 1, 2019. Global Equity is represented by MSCI ACWI GR CAD; U.S. Equity is represented by S&P 500 TR CAD; Global Growth Equity is represented by Russell 1000 Growth TR CAD; Global Value Equity is represented by Russell 1000 Value TR CAD; Money Market is represented by iShares Premium Money Market ETF Comm. Indices are unmanaged and cannot be invested in directly.

What’s keeping investors from investing in the markets (and themselves)?

One word: Risk. Risk is the most significant factor in keeping investors from using the markets to plan for their future1. But understanding risk and how it can work to an investor’s advantage is key.

1 Source: A study on factors affecting an investment decision Pranjal Shah, Ranchi University, Ranchi, Jharkhand. 2023.

Understanding your tolerance for risk

Investors tend to fit into one of six risk profiles, each with a target long-term strategic allocation that aligns with their risk appetite.

|

Very Conservative |

Conservative | Balanced | Moderate Growth | Growth | Aggressive Growth | |

| Equity | 0-20% | 10 - 30% | 40 - 60% | 70 - 80% | 80 - 90% | 80 - 100% |

| Fixed income | 80-100% | 90 - 70% | 60 - 40% | 20 - 30% | 10 - 20% | 0 - 20% |

It’s important to note that if an investor fits into one profile today, it doesn’t mean that profile will suit them forever.It is s a good practice to ensure an investor’s portfolio continues to align with their risk tolerance, investment time horizon and return objectives.

Understanding risk and where the opportunities lie

Understanding the level of risk an investor can stomach is one factor, but understanding risk itself, how it affects them, where it comes from and how they can use it to their advantage can help them make better choices for the long term.

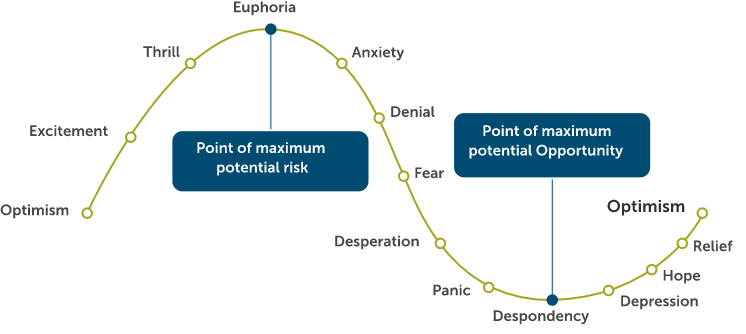

Step 1: Understanding where they are in the investment emotional spectrum over a market cycle

Investing can involve a broad spectrum of emotions, and knowing where an investor’s risks and opportunities lie within them is key. The unfortunate reality is that people tend to invest in the opposite of what benefits them.2

2 Source: This impulse makes investors sell low and buy high, CNBC, published April 26, 2016 based on the BYU study: The Effects of Loss Aversion and Investment Type on the Sunk Cost Fallacy, Veronika Tait & Harold Miller Jr.

Solution: Investor’s can avoid the emotional rollercoaster by working with a licensed advisor to put in place a dollar cost averaging strategy to invest throughout market ups and downs. More on dollar cost averaging. Download here

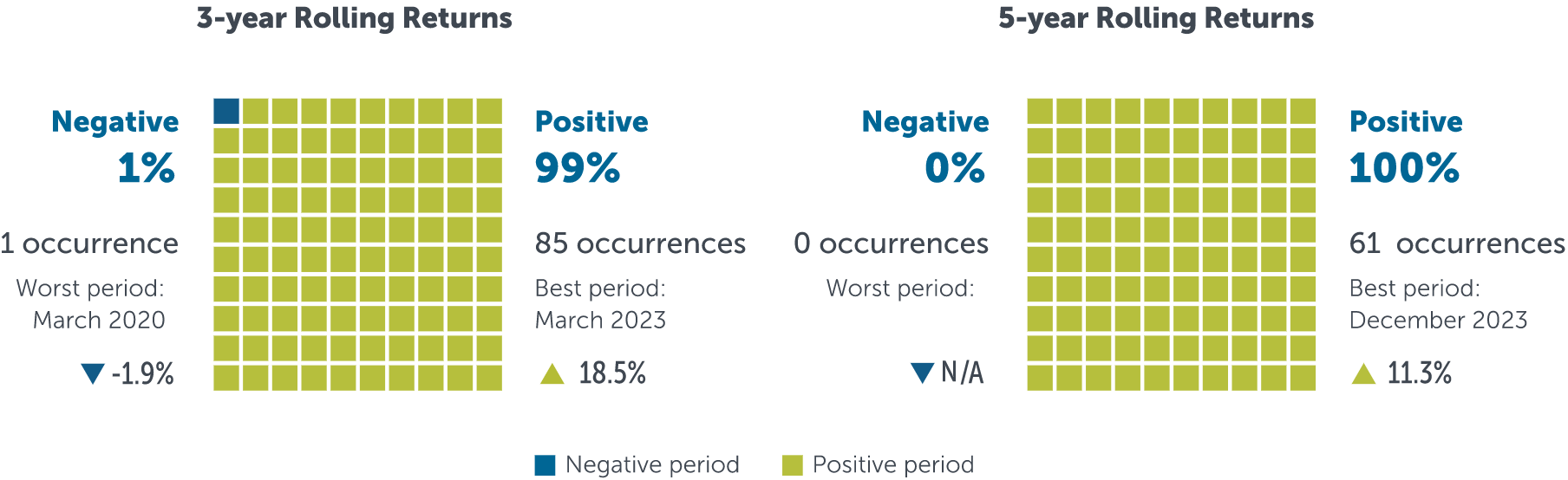

Step 2: Get some perspective.

Unpredictable markets, interest rate uncertainty, rising costs of living, and geopolitical tensions can all lead to anxiety and stir concerns among investors. But when you look over the medium to longer term, a clearer picture of risk begins to come through.

S&P/TSX Composite Total Return Index

Source: Morningstar Research Inc., as of June 30, 2024. Based on a 10-year period starting July 1, 2014.Source: Morningstar Research Inc., as of June 30, 2024. Based on a 10-year period starting July 1, 2014.

Markets have historically seen expansions and contractions, yet generally trend upwards, emphasizing the importance of a longterm approach for successful investing.

S&P/TSX Composite (TR) Index

Source: Morningstar Research Inc. as of June 30, 2024. The contraction periods are marked by a greater than 5% drop from the previous periods before a relative correction upwards. The start date was December 1, 1999.

Step 3: Getting invested…comfortably.

Taking on risk can be a scary prospect for many. Investors can better understand their risk tolerance by considering the amount of time they plan to invest (time horizon) and their ability to endure market volatility and their overall confidence in the near-term performance of the market.

Step, Walk or Run

back into the markets based on your comfort level

Step: An investor who finds excitement in the everyday events of life. They don’t believe in taking unnecessary risks but understand the need for some risk to achieve their long-term financial goals. Their time horizon is limited, but it still offers some room for growth.

They might benefit from investment options that carry a level of stability through an allocation to fixed income but still provide the opportunity for capital growth:

| Fund | Target Allocation (FI/Eq) |

Risk Classification |

| Empire Life Income GIF | 70/30% | Low |

| Empire Life Emblem Global Conservative Portfolio GIF | 70/30% | Low |

| Empire Life Canoe Conservative Portfolio GIF | 70/30% | Low |

| Empire Life Multi-Strategy Global Conservative Portfolio GIF | 70/30% | Low |

Walk: A person who seeks balance in their endeavours and believes that having exposure to risk and return potential is equally necessary to achieving their goals. Has a moderate time horizon with many years of growth still available. Is comfortable with more risk as well as investment options that allocate more equity, with some offering exposure to specific investment styles or areas of the market.

| Fund | Target Allocation (FI/Eq) | Risk Classification |

| Empire Life Fidelity Global Balanced Portfolio GIF | 40/60% | Low to Moderate |

| Empire Life Emblem Global Balanced Portfolio GIF | 40/60% | Low to Moderate |

| Empire Life Asset Allocation GIF | 30/70% | Low to Moderate |

| Empire Life Global Asset Allocation GIF | 30/70% | Low to Moderate |

| Empire Life Multi-Strategy Global Moderate Growth Portfolio GIF | 30/70% | Low to Moderate |

Run: A person who feels confident in the long-term direction and growth potential of markets and has a risk profile that fits the historical volatility of investment options that carry the greatest long-term growth potential.

| Fund | Target Allocation (FI/Eq) | Risk Classification |

| Empire Life Emblem Global Moderate Growth Portfolio GIF | 20/80% | Moderate |

| Empire Life Multi-Strategy Global Equity Portfolio | 0/100% | Moderate |

| Empire Life Global Equity GIF | 0/100% | Moderate |

| Empire Life International Equity GIF | 0/100% | Moderate |

Benefits of Empire Life GIF segregated funds | Protection for life

Whatever investment option that is chosen, the Empire Life Guaranteed Investment Fund segregated fund contract can provide the guarantees and benefits to help investors save for their future.while protecting that of their loved ones.

Benefits of Empire Life GIF

- Automatic Annual Death Benefit Guarantee Resets

- Maturity & Death Benefit Guarantees*

- The possibility of creditor protection

- Efficient, private wealth transfer to named beneficiaries

The maturity and death benefit guarantees are reduced proportionately for withdrawals.

This document reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing. Performance histories are not indicative of future performance.

Policies are issued by The Empire Life Insurance Company.