| |

Help your clients give the gift of life insurance this holiday season!

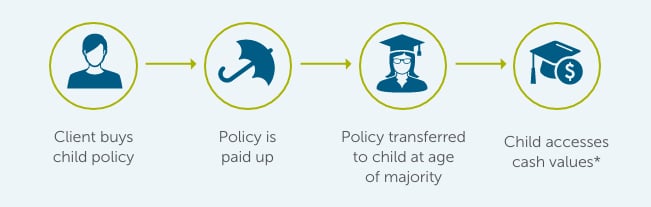

Kid Start from Empire Life is a whole life insurance strategy that leverages the tax advantages of individually owned life insurance to help your clients give the next generation a financial head start in life. Kid Start offers a number of advantages over traditional financial vehicles used for tax-advantaged intergenerational wealth transfer.

Here's how it works:

Pair Kid Start with 20-Pay EstateMax® Participating Whole Life

With highly competitive total premiums and guaranteed values, EstateMax is the ideal engine to power a Kid Start strategy. See for yourself how it compares to other leading plans when it comes to guaranteed cash values* (GCSV) in adulthood:

Estate PAR Plan 20-Pay with Enhanced Dividend Option‡

|

|

All Values Guaranteed at Issue**

|

| Female, non-smoker, aged 0 |

Empire Life EstateMax 20-Pay |

Competitive Product A |

Competitive Product B |

Competitive Product C |

| Monthly Premium |

$40.42 |

$40.42 |

$40.42 |

$40.42 |

| Insurance Amount |

$100,000

|

$93,274 |

$29,175 |

$63,897 |

| GCSV Year 20 |

$4,876 |

$4,046 |

$1,263 |

$2,506 |

| GCSV Age 65 |

$22,744 |

$17,592 |

$6,905 |

$16,693 |

|

‡ Values shown are based on a comparison of Empire Life EstateMax 20 pay with Enhanced Dividend option for a Female, aged 0, to three other comparable PAR products for the same life insured. Competitive Product A is Equitable Life Equimax Estate Builder, Competitive Product B is Desjardins Estate Enhancer and Competitive Product C is Canada Life Estate Achiever Plus. Premiums and values for all products shown are based on quotes run with companies' illustration software on November 22, 2022.

|

Please visit our website to access Kid Start resources, including a video that you can watch and share on social media.

Click below to watch and share!

|

|