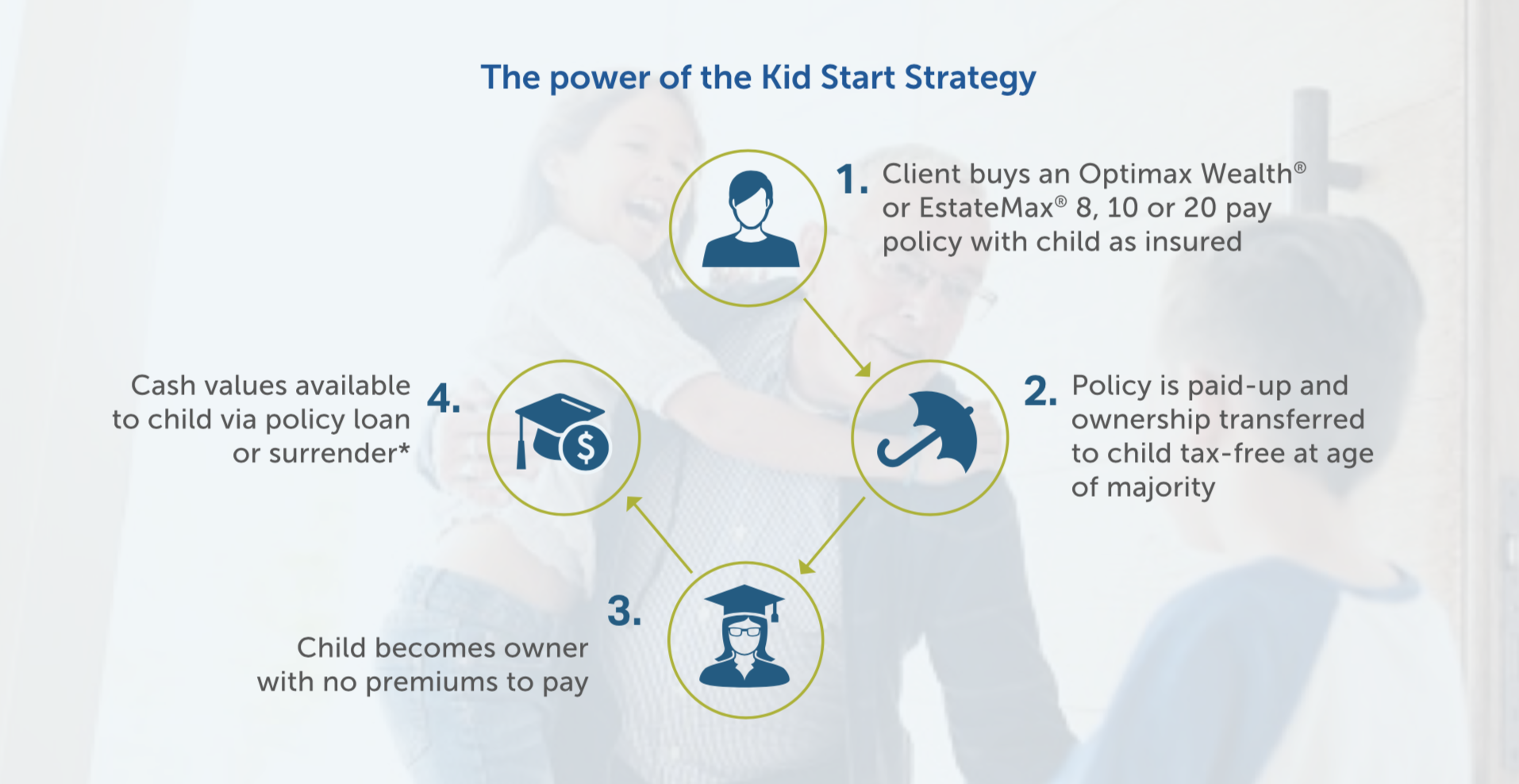

Kid Start from Empire Life is a whole life insurance strategy that leverages the tax advantages of individually owned life insurance to help your clients give the next generation a financial head start in life.

Kid Start offers a number of advantages over traditional financial vehicles used for tax-advantaged intergenerational wealth transfer, including:

Access to cash via policy loan or cash values* to use for any purpose including starting a business or buying a home. |

Coverage for life bought when the insured is young and healthy. Can be fully paid-up in 8, 10 or 20 years and is compatible with Empire Life’s Annuity Funded Life Insurance strategy. |

|

Interested in learning more?Please contact your Account Executive or call our Sales Centre Team at 1 866 894-6182 or by email at salescentre@empire.ca. For the full line-up of product and marketing resources, visit and about Empire Life the Participating Life Insurance section of this website. |

*Cash Value Savings are a portion of paid premiums for Whole Life Insurance that is set aside by the company for investments. These funds may be accessed through a policy loan (standard interest rates will apply) or by surrendering all or part of the policy. Any portion surrendered will reduce the Death Benefit accordingly. Any cash value withdrawn from the policy, if taxable, is taxed in the hands of the owner. Please see policy contract for more details. Withdrawals may reduce value, assuming payments are made; a policy loan carries more risk.