Get the benefits of segregated fund guarantees and earn an attractive return on your investments, providing you with a “safe haven” while taking advantage of the current market environment.

Money Market segregated funds are fixed income funds that invest in short-term securities which may allow you to:

Quickly take advantage of changes in interest rates.

Earn higher returns while you wait for more favourable market conditions.

The fund provides a competitive interest rate with the insurance benefits of segregated funds.

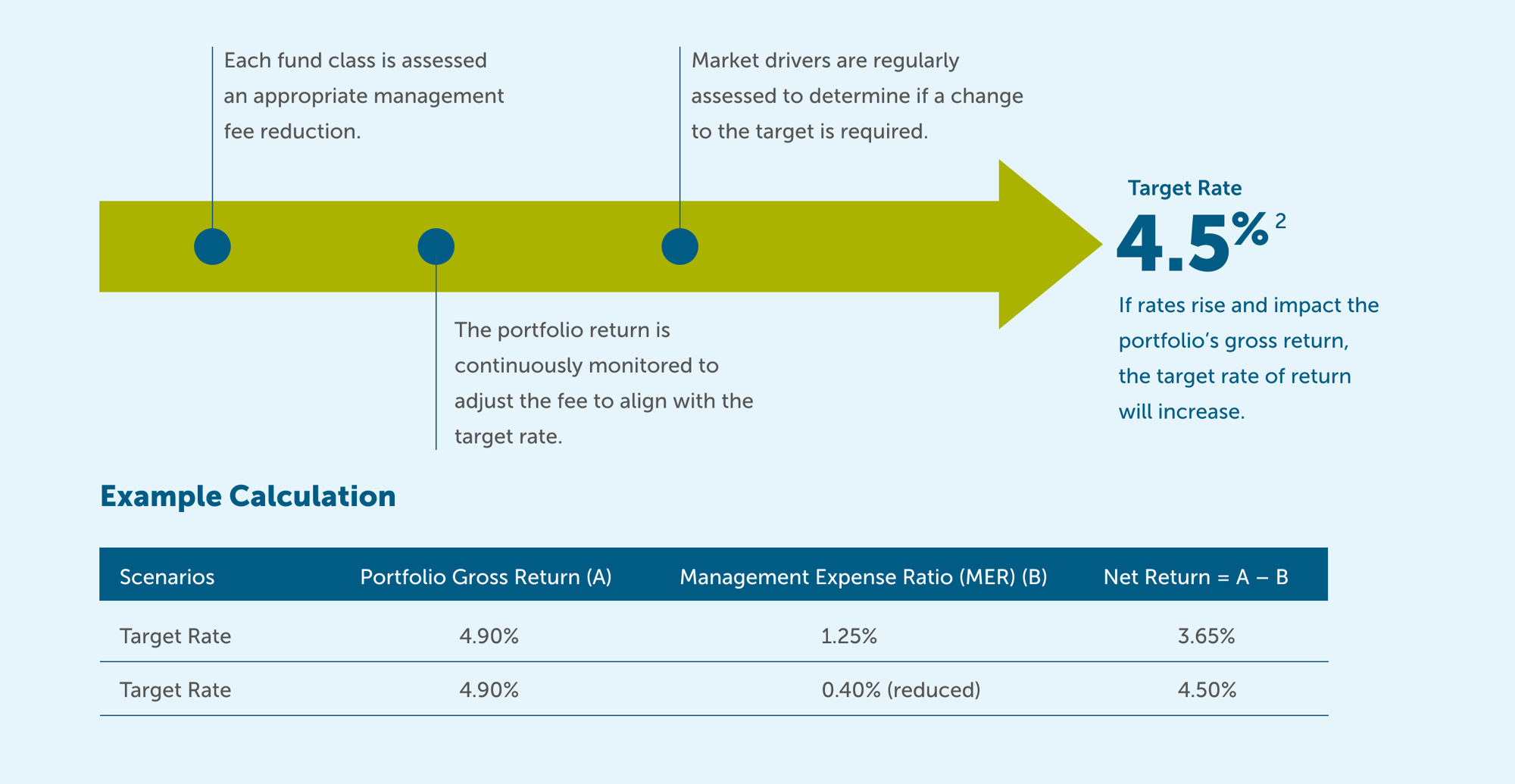

This is achieved by temporarily1 waiving part of the management fees for each fund class within the fund.

The benefits of segregated fund guarantees.

Coupled with maturity and death benefit guarantees, including annual death benefit guarantee resets, Empire Life segregated fund guarantees help protect the value of your investments while you take advantage of the current market.

• Choice of 75% or 100% maturity benefit guarantee.3

• Choice of 75% or 100% death benefit guarantee on deposits made to age 90.3

• Automatic annual death benefit guarantee resets until age 80 to lock in market gains.

• Freedom from estate and probate fees if you name a beneficiary other than your estate.

• Potential for creditor protection which may be particularly valuable for small business owners.

*The Current Effective Annualized Return shown is for the Empire Life Money Market Fund-Class L as of the date shown and was calculated using the formula: current yield = (seven day return x 365/7) x 100. The Current Yield shown also reflects a temporary waiver of certain management fees as outlined in the Empire Life Money Market Fund Flyer. Past performance is not a guarantee of future returns. The time-weighted annualized return for Empire Life Money Market Fund Class-L as of March 22, 2024 is as follows: 1-year: 4.55%, 3-year: 1.61%, 5-year: 1.19%, Since Inception: 0.73%.

1 Empire Life’s target is to provide the annualized 4.5% rate of return for a limited period from July 1, 2023, to June 28, 2024. Empire Life may, at its discretion, at any time and without prior notice, increase or decrease the amount of the Money Market management fee waived, which will therefore affect the rate of return. Empire Life reserves the right to revise and/or cancel this rate at any time.

2 Available July 1, 2023 – June 28, 2024. Empire Life reserves the right to revise and/or cancel this rate at any time.

3 Maturity and death benefit guarantees are reduced proportionately for any withdrawals.

Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing. Past performance is no guarantee of future performance. All returns are calculated after taking expenses, management and administration fees into account.

© Registered trademark of The Empire Life Insurance Company. Policies are issued by The Empire Life Insurance Company. All rights reserved – 2024.