On April 24, 2025, we announced important enhancements to our Solution Series® Term Life Insurance. These updates make our term life insurance even more competitive and valuable for your clients.

Reprice Solution 10 and 20, with standard non-smokers seeing average premium decreases: 3% on Solution 10, 1% on Solution 20.1

During the first seven policy years, clients can exchange a Solution ART®, Solution 15®, Solution 10 or 20 coverage for new coverage that is at least 10 years longer.

Clients can do a partial term conversion and carry over the remaining term insurance up to the original coverage amount, no medical evidence required.

We also introduced a new premium band for Solution 10 and 20 for insurance amounts of $5,000,000 or more.

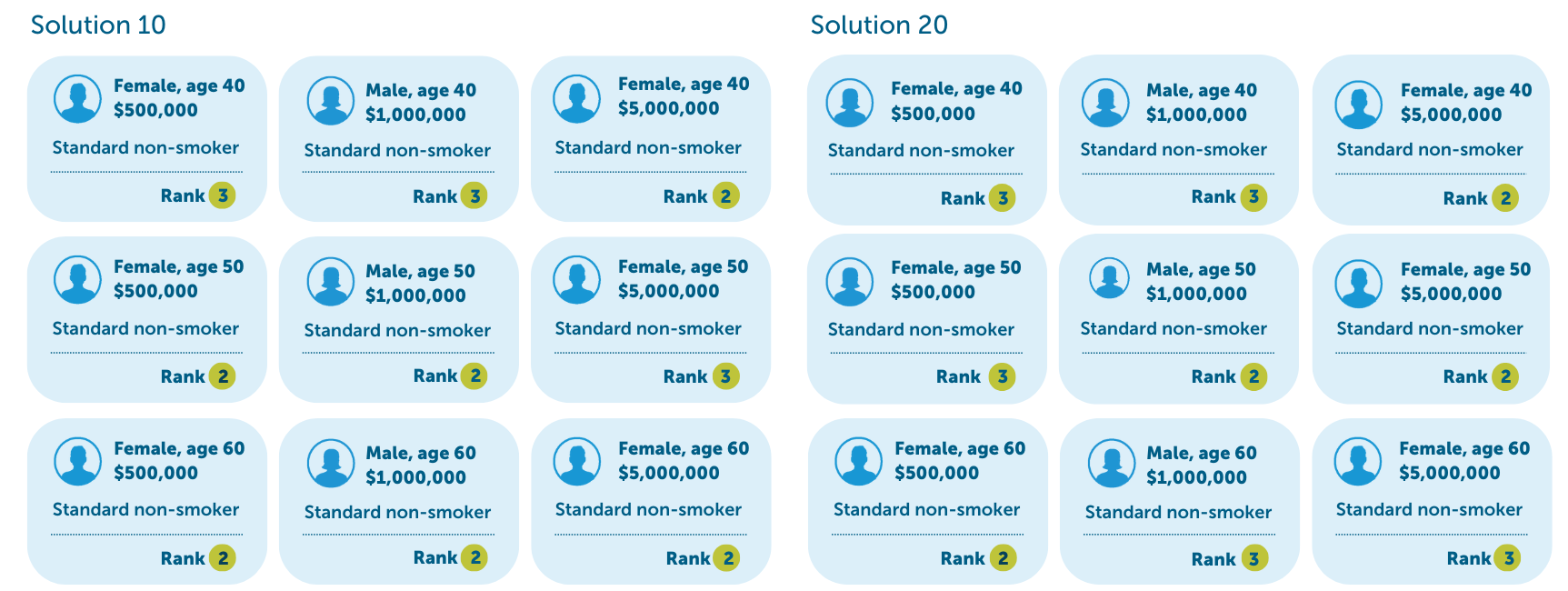

See the improved rankings for yourself in these key target scenarios:

1For all issue ages, sex at birth, standard non-smoker rates

2Rankings based on initial premium rates for Solution 10 and Solution 20 compared to 20 other comparable term products for standard life insured, both smoker and non-smokers, face amounts of $50,000, $100,000, $250,000, $500,000, $1,000,000, $1,500,000, $2,000,000, $2,100,000, $2,500,000, $5,000,000, $7,500,000, $10,000,000, using LifeGuide quotes as of September 17, 2025 for the comparable products.

3Median time-to-issue contracts based on Fast & Full life applications that use eHQ, are “auto-approved”, and where eContract delivery is selected and owner(s) and life insured(s) validate email addresses when application is signed, vs. paper application. Empire Life data on file from February 1, 2025 to February 28, 2025.

.png)

Policies are issued by The Empire Life Insurance Company.

® Registered Trademark of The Empire Life Insurance Company

FOR ADVISOR USE ONLY

QUICK LINKS