With the significant increases in the average cost of recreational properties such as cottages, are they aware of the potential capital gains tax liability that may become payable to keep the cottage in the family?

To better equip you for speaking with your clients, we have created the following materials to assist you:

This document helps clients understand how a participating whole life insurance policy compares to a non-registered investment in addressing any capital gains tax.

Understanding how a participating whole life insurance policy with an Additional Deposit Option (ADO) compares to a non-registered investment in addressing any capital gains tax.

Please contact your Account Executive or call our Sales Centre Team at 1 866 894-6182 or by email at salescentre@empire.ca.

Need more information or want to speak to an Empire Life Tax & Estate Planning specialist about a case? Speak to your Account Executive to book a meeting.

For the full line-up of product and marketing resources, visit the Participating Life Insurance section of this website.

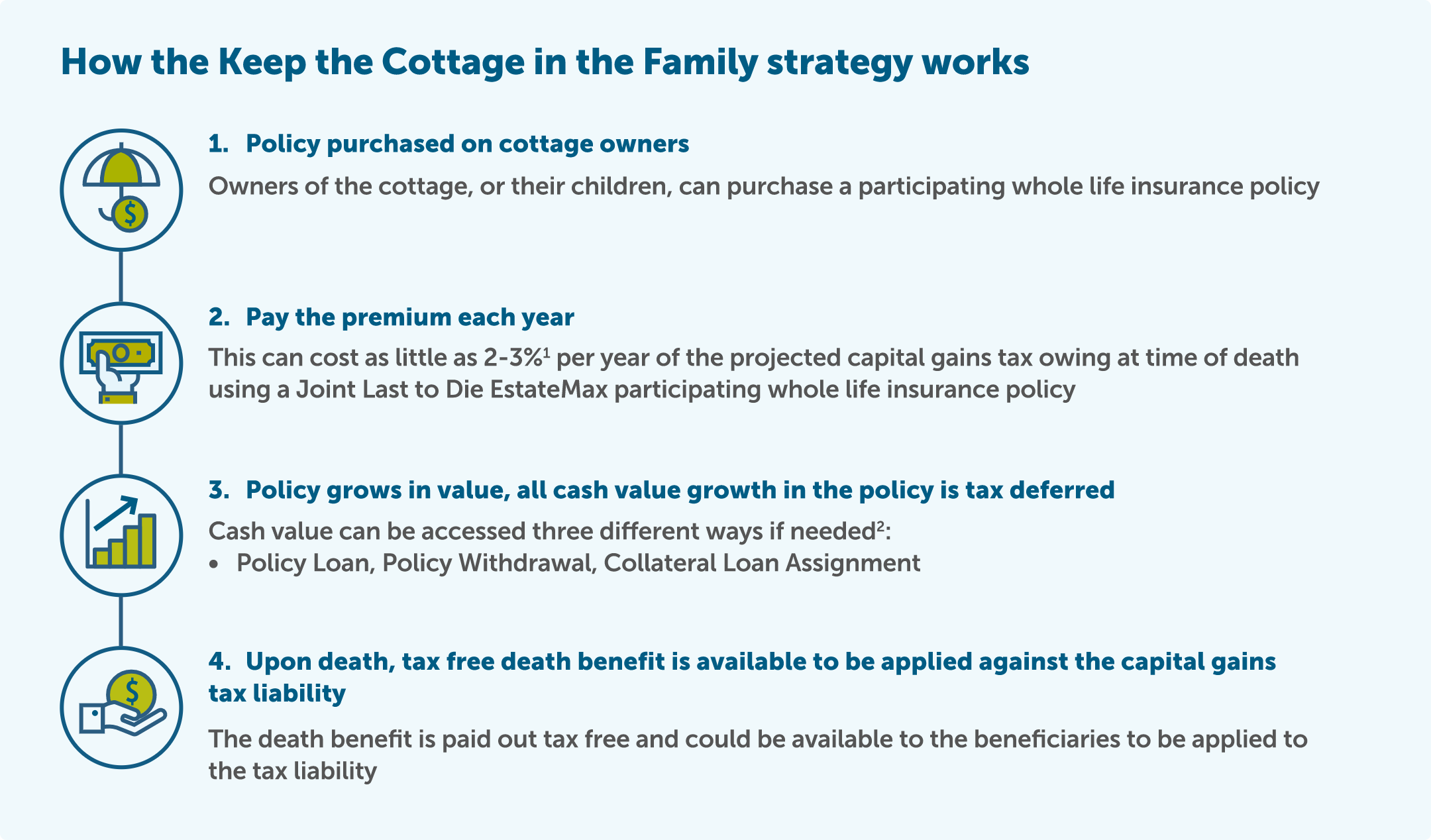

1 EstateMax, Joint Last to Die, Life Pay, standard nonsmoker, single equivalent age of 40 (both clients actual age 50)

2 Taxation may apply and a tax slip will be issued as appropriate

The Empire Life Insurance Company

259 King St. E. Kingston, Ontario, K7L 3A8

1 877 548-1881

8:30 am to 5:00 pm, EST weekdays

© 2001 - 2024 The Empire Life Insurance Company. All Rights Reserved.